No one really talks about how to construct portfolio in this next sector. In this substack, I will breakdown some of the sub-sectors of crypto.

Analyzing a Coin or Stock For Investment: Narrative, Community, and Fundamentals

Narrative:

What is the popular consensus? After all your reading, what is being said about the investment? What is the story?

Community:

Are enough people looking at this investment? How big is the following? Will it get attention? What is it’s marketing ability like? Who runs it? Are they popular?

Fundamentals:

How does the stock/company solve a large market problem? How does the coin impact the industry? What is the significance? How is it structured?

My opinion:

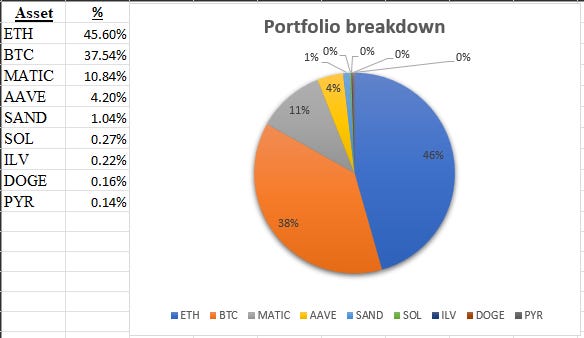

A portfolio should be structured by investing 80% (majority) into Bitcoin and Ethereum. The other 20% can be spread across smaller altcoins. In this portfolio example, we cover exposure in

Metaverse (SAND)

ETH scaling and ZK rollups (MATIC)

Blockchain Gaming (PYR) (ILV)

These seem to be large communities wi…