Please link your account to access the premium discord channels:

Last two week: I took another hit in the 1st challenge account for -50k which means I will be taking a break from short term options. This is exactly why most of my positions are in January calls, because I did not want to burn cash in the election seasonality volatility.

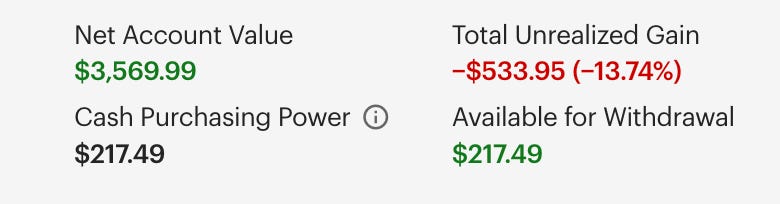

2nd Challenge Account: 3k to $3.5k (down from $6.7k high)

(first one is $6k to $275k in less than a year)

I am still struggling to get momentum in this account, but the post election move will provide some clarity and less uncertainty.

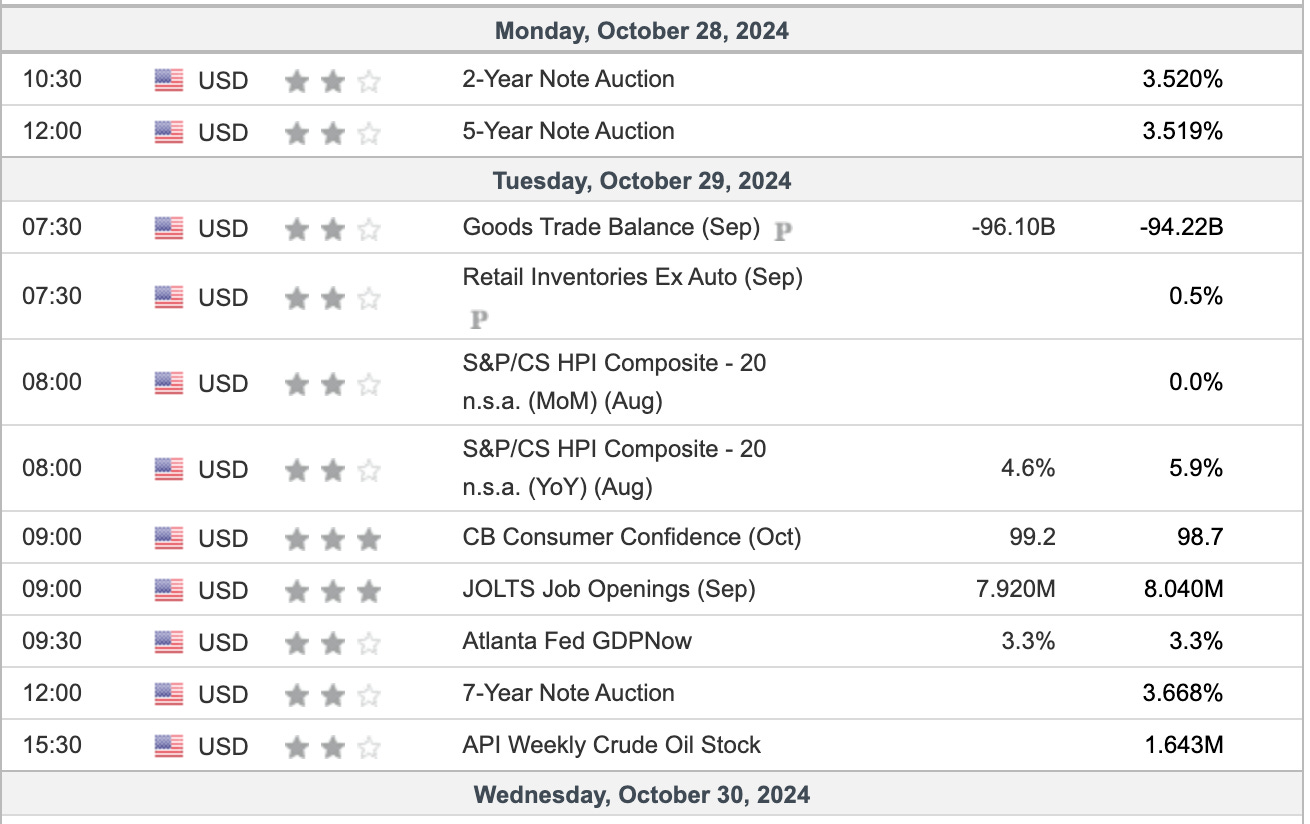

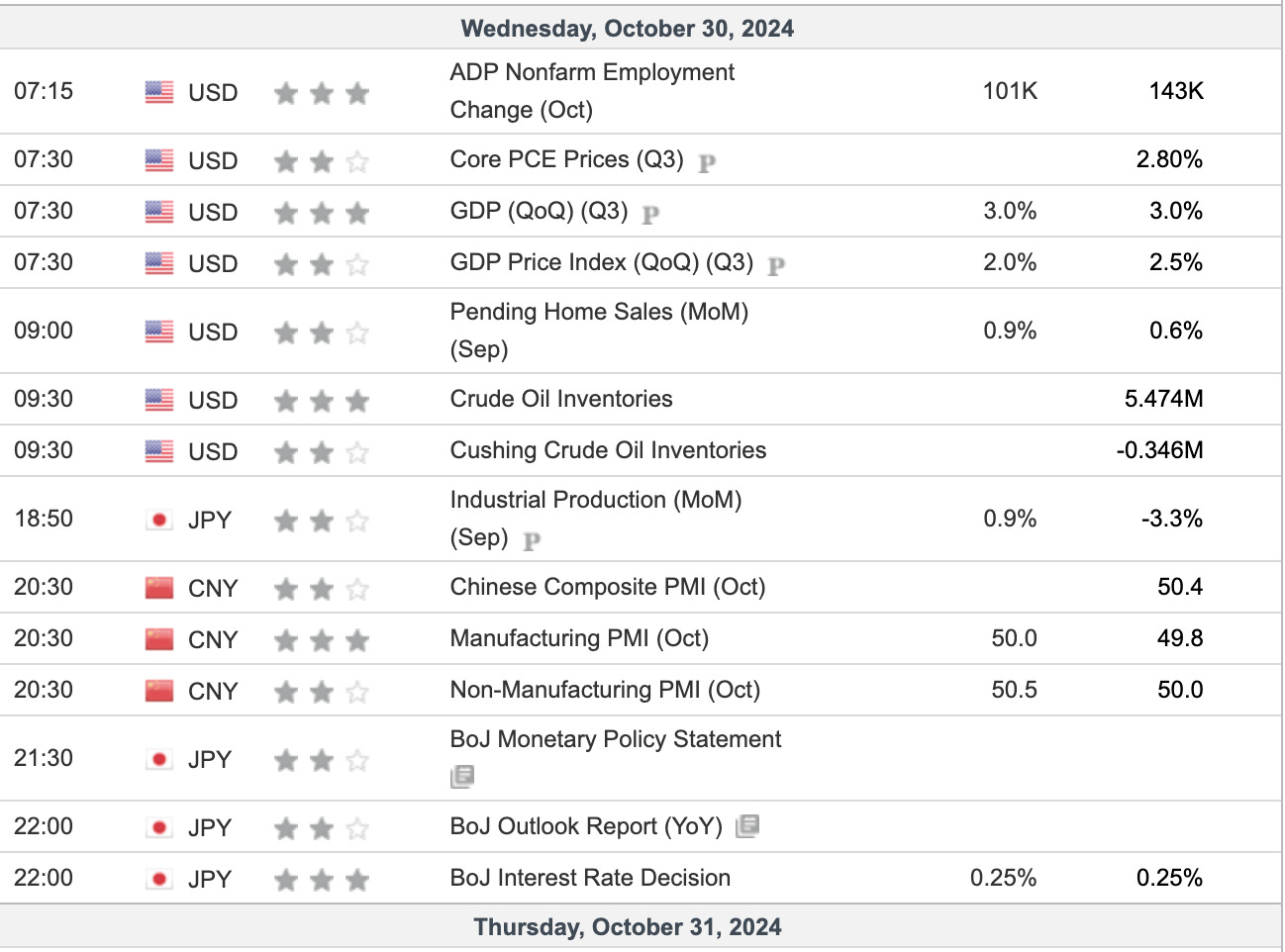

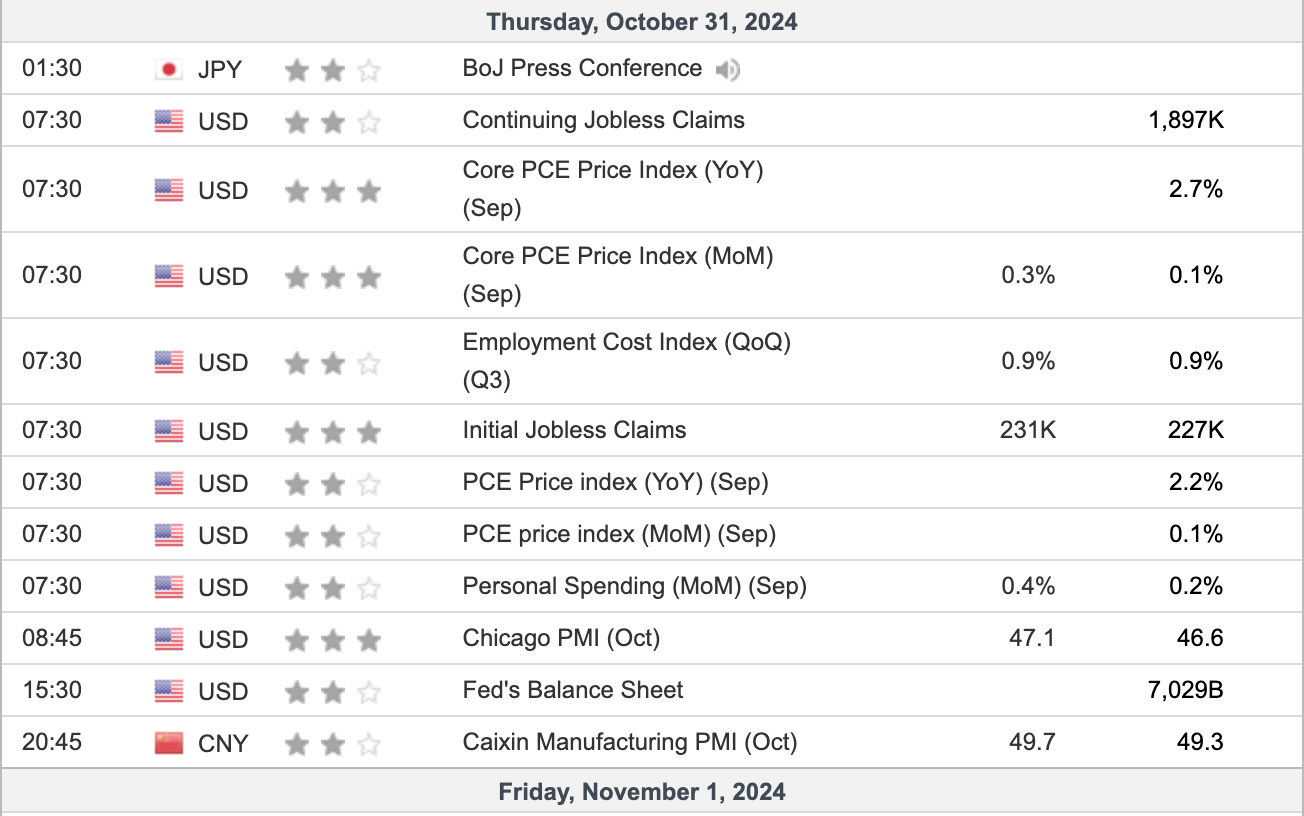

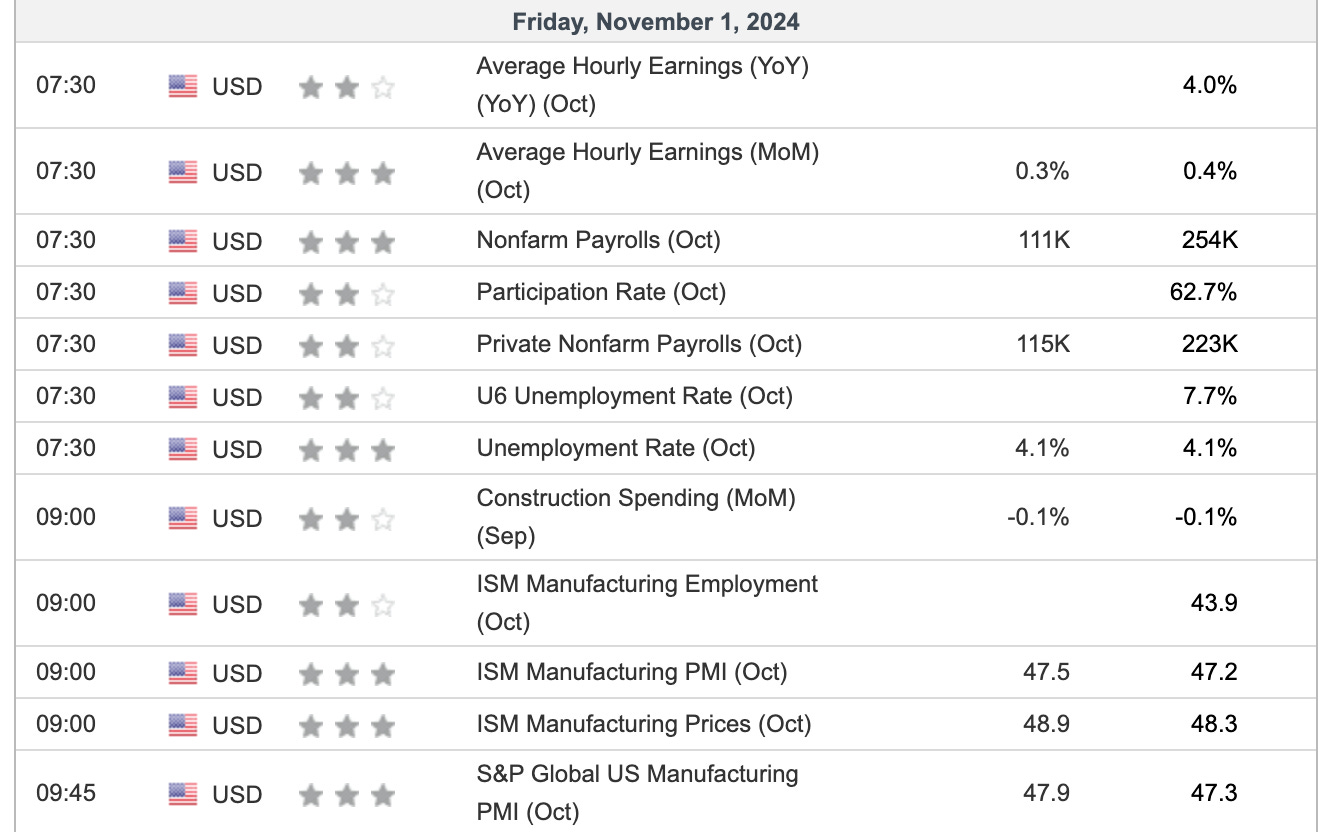

A softer print on jobs might help buoy rates. If rates can relax a little bit, it could provide some relief to IWM and small caps. Since it’s nearly the election, construction spending is going to come in lower as well…homebuilders and contractors holding back on CAPEX with the uncertainty of who enters the white house and dictates how spending will be allocated over the next four years.

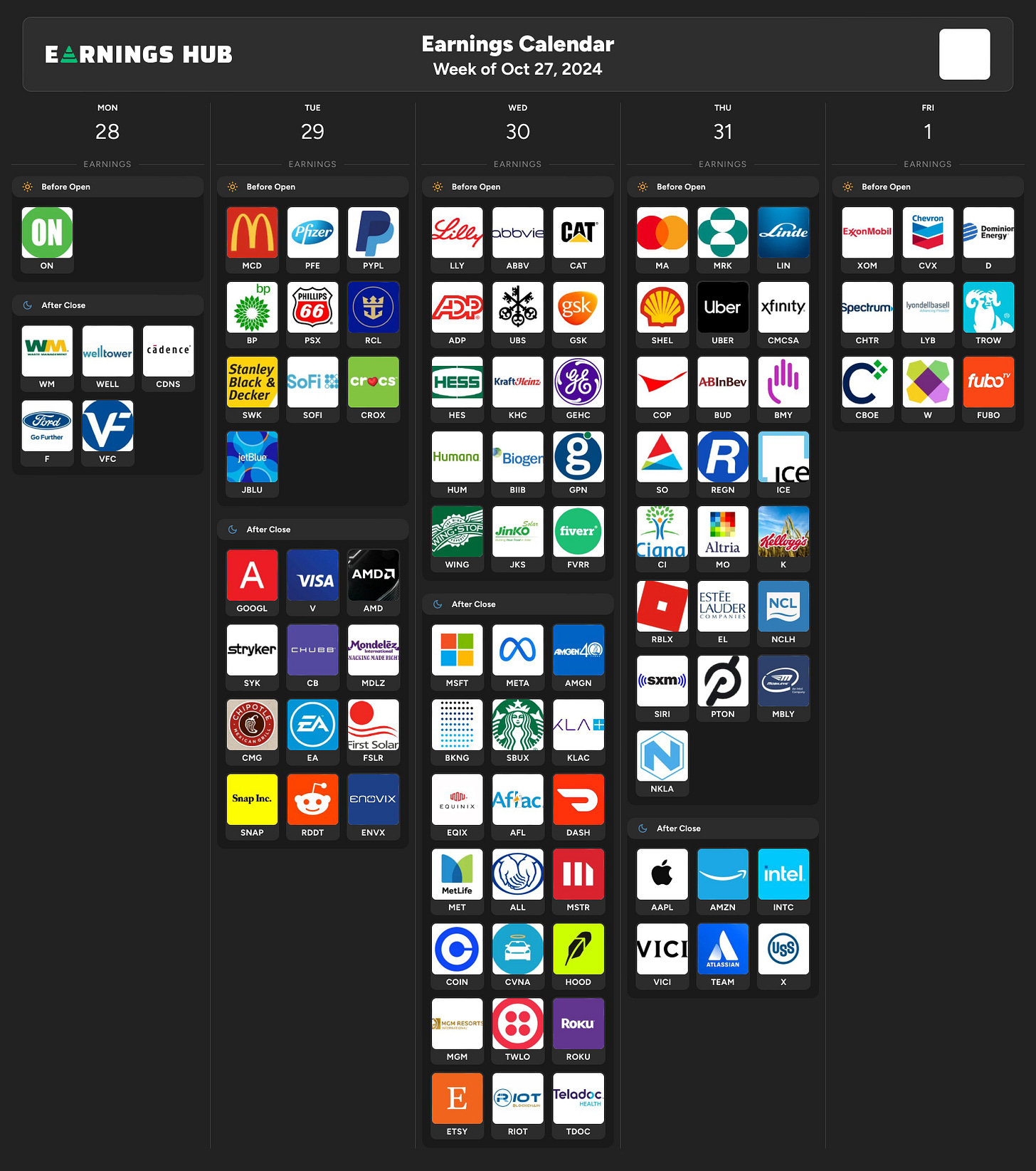

Big tech on deck with earnings. This is not something I will participate in, but TSLA did continue to set the example of strong earnings reactions just like the big banks the week prior. It would be nice to see this pattern continue with strong reactions.

The big thing is that this is the last full week of trading before the election. We are about to enter a pivotal environment change in the market.