Review:

In my last two posts, I was looking for a major selloff and crash into January 2023.

What happened?

Goldilocks Market? Treasury General Account? Zero Day Options(ODTE)?

WHAT IS IT!!

The Bond Market: Rates

US 2-year Bond Yield (ORANGE) versus Federal Funds Rate (BLUE)

The same story over and over again. The Federal Reserve hikes rates as the bond market re-prices the cost of capital for the economy.

FOMC rate decision is next week. February 1st. If they hike rates AT ALL (25 or 50bps), they are fighting the bond market. The crossover has happened. In the past, they have paused. What happens when they over-tighten?

Notice how previous stock bear markets that the fed was already cutting rates?

Yeah this time around, it’s not as simple. The mass amount of money printing has caused major distortions.

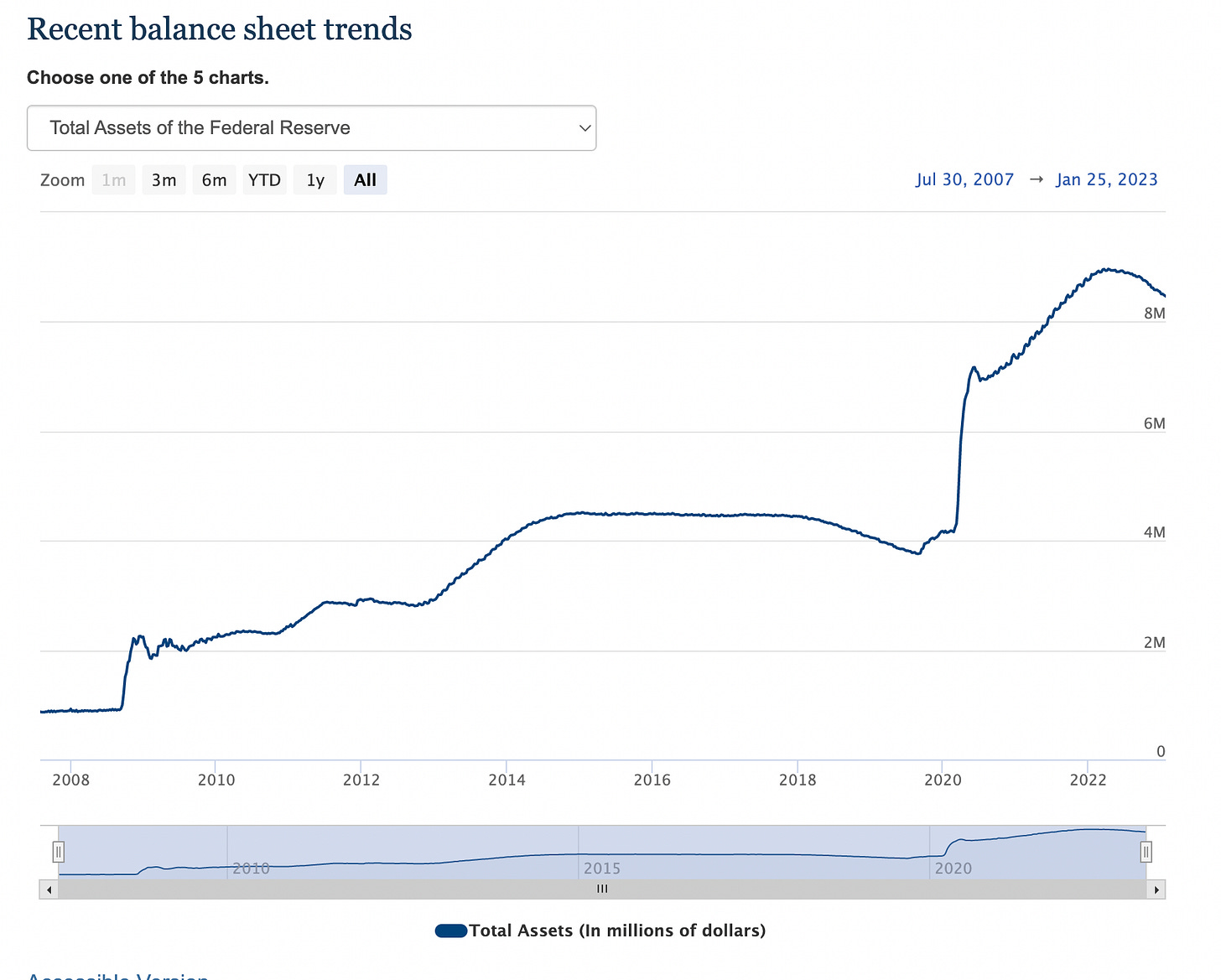

Federal Reserve Balance Sheet (US CENTRAL BANK): SOVEREIGN DEBT

Ever since 2008, The Federal Reserve has monetized US Debt to stimulate US economy with the balance sheet…The major buyer of US issued debt by the US Treasury since early 1900s.

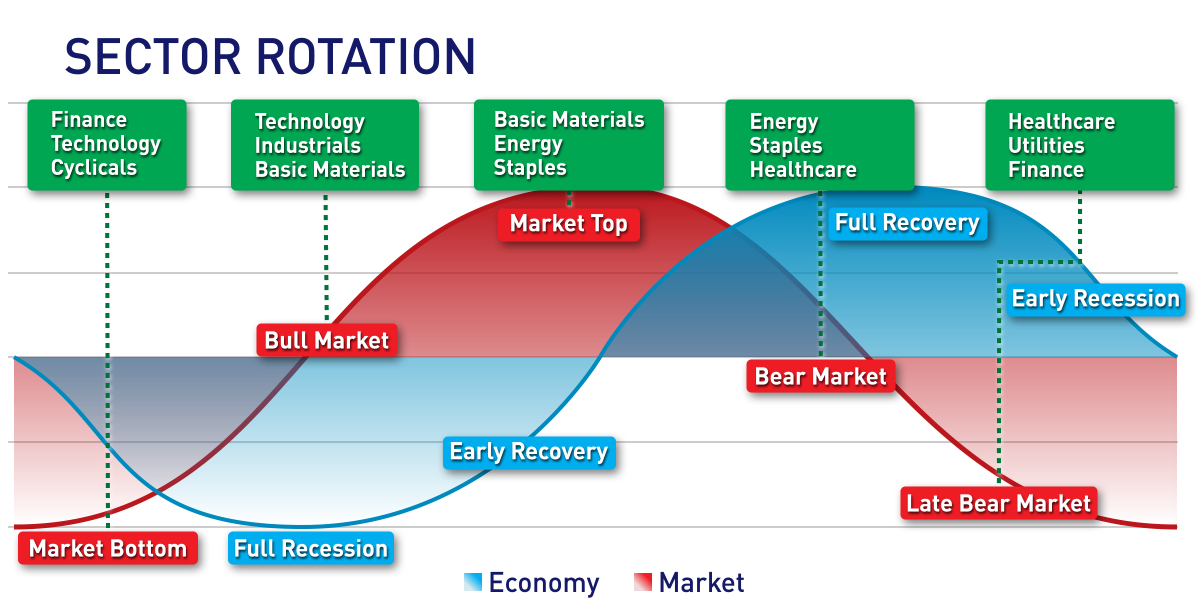

As you can see, we are in the tightening part of the cycle. There is no free-money spigot right now. The contraction.

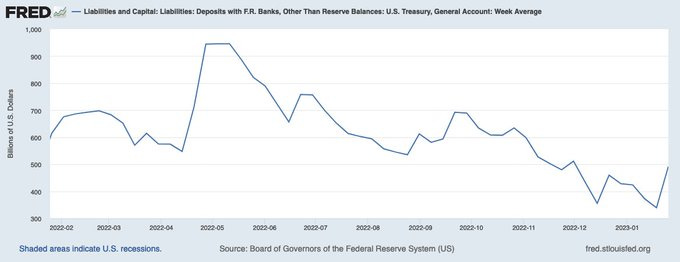

Treasury General Account: TGA

Theoretically, this is responsible for the latest Risk-On rally, fiscal spending.

IN THE MIDST OF A DEBT CEILING CRISIS NOW

It is ticking up, therefore spending has decreased. Will markets react and sell-off in the next few months? Yes.

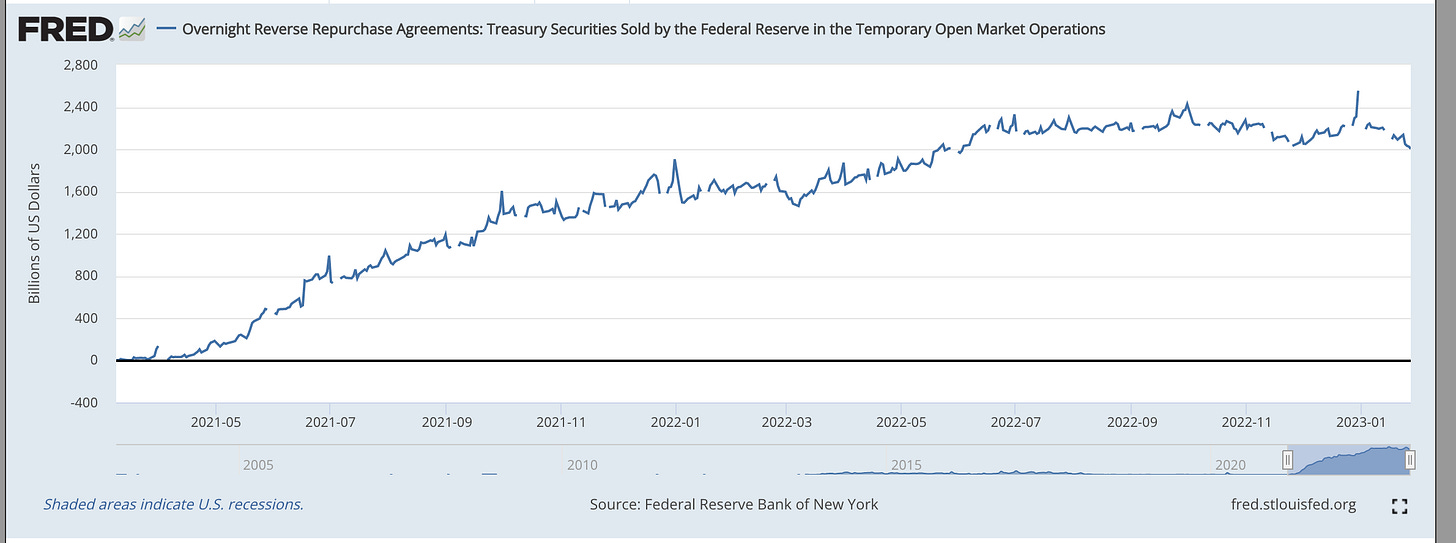

Reverse Repurchase Market: Commercial Banks lending $ to the Federal Reserve

In the past couple years, we have seen a major change in the dynamic between commercial banks and the Federal Reserve (US Central Bank).

Instead of the Federal Reserve lending to the Commercial banks, Commercial Banks are lending to the Federal Reserve. This has never happened to this degree…To the point that the Federal Reserve is experiencing its first operating loss as a bank IN HISTORY.

I have no idea what that means other than that the risk of bankruptcy has gone from Commercial Banks (2008 Financial Crisis) to Sovereign banks (National governments)

So who bails out a state government? International Monetary Fund?

Who takes on the next major bailout? Because it’s all an expanding game of risk.

The World Reserve Currency: Mighty US Dollar $DXY

The US dollar Index. Pretty major level. The currency that rules all other currencies, yet is the cleanest of all the dirty fiat currency.

When this moves up from this level, the US dollar gains value. US purchasing power goes up. You can buy more with your US dollar.

In turn, everything else becomes cheaper. EVERYTHING.

Volatility Index: $VIX Fear index/Implied Vol

There is no fear in the market. What’s that warren Buffet quote?

“be fearful when others are greedy, and greedy when others are fearful.”

Equities: $SPX

Equities…the last thing you want to look at. Why? Because it’s the most emotional market. 20% downturn is a “bear market.”

I am sorry to say, but this is a false break-up. Go look at 2000 and 2008 bear markets.

I expect new lows this year in the stock market.

If I am wrong, then cheers, we all win with our portfolios.

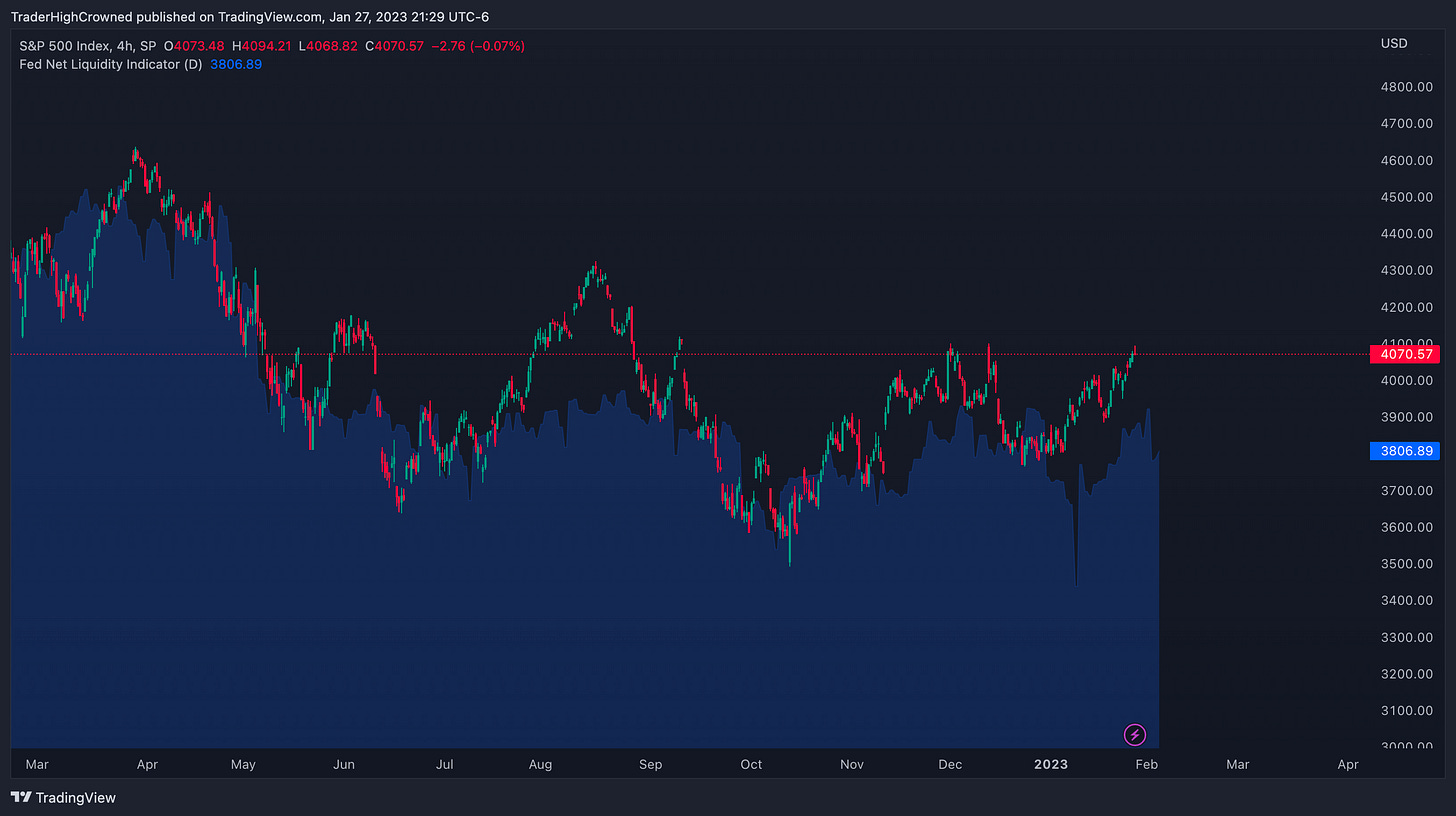

Market Liquidity: Driving the market

As a major leading indicator, liquidity in the market can help see how financial conditions are. Tight or Loose? For the past few months, we have seen a loosening of financial conditions.

I am expecting this to turn down soon.

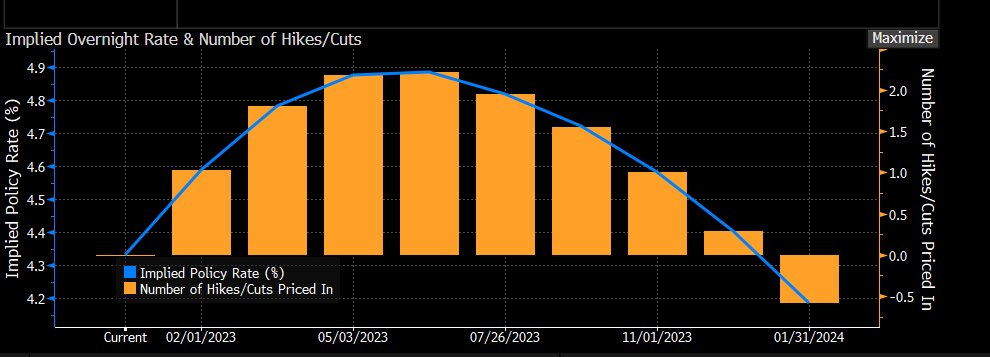

Implied Federal Funds Rate / Narratives: Soft Landing, Goldilocks Market, Crash

These three narratives will be picked apart here.

First of all, If they hike at all this week’s meeting (2/1 Wednesday), it is technically overtightening based off of what the bond market is saying. Therefore, The Goldilocks market of Risk-On is invalidated.

Secondly, Soft landings are peddled by banks. It has no validity in my opinion, just a buzzword for mainstream media to talk about in counter of a recession argument.

Finally, the crash narrative. Double dip recession. I am bias towards this happening because of my research. Why would the Federal Reserve want to deal with inflation again?

This is not Volker era of small government deficits and borrowing. The US government has over 30T of debt that must be refinanced. Do you really think it’s smart for the US to pay something like $1T in interest?

I believe they will continue to work towards 2% inflation and smush any upticks which in turn means that interest rates will lower.

From MACRO to MICRO

Now that we have covered the macro layout, we can cover the smaller details.

Sometime in November, options became available for each day of the week. It was only 3 days a week before this change. Since this change, the market is much more choppy intra-day. This change allows big players to steer price with such short term leverage. For now, they have the beast under control , but I believe this financial creation will turn out deadly in the future.

Big tech earnings are continuing this week. I am in the boat that you should not be short or long during these weeks. It is a traders market. That being said, I am seeing a rout of volatility and red days mid February once everything has been processed.

Miscellaneous

US/NATO proxy war against Russia continues. Lately NATO is sending tanks to Ukraine which is very escalatory. I am not sure when something to exactly happen to affect the markets, but it is a sleeping black swan in my opinion. China/Taiwan tensions are in the same boat.

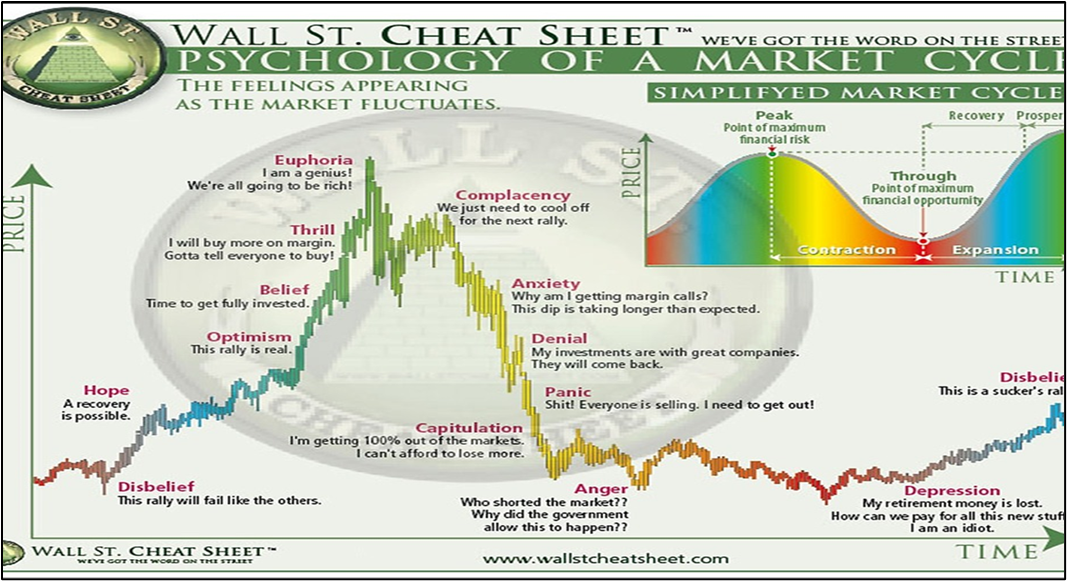

Market Psychology

As of now, this market is a traders market. None of this environment is for stock pickers for multi-year holds. This does not stop your brain from thinking that the market is gunna set new highs. I repeat again, the market’s job is to get 99% of participants offside before making a move on any timeframe.

These charts always help gauge things. I see us in complacency while worthless stocks rally over 50% in the first month of 2023. Also, there are many frauds still swimming such as Adani. There is more deleveraging to come.

CTAs once again are buying the up-tick tape. They are net long again…another good signal to begin shorting.

Final Remarks

I do not have much to say about Bitcoin crypto. We have seen a wonderful rally from 15.5-24k the past couple months. This highly volatile industry needs more time to cool down.

I repeat this again, the next year or so is the time to fill your bitcoin and crypto bags before the next halving.

Important date: April 2024 bitcoin production gets cut in half again.

We can range between ~15k and 40K until then.

CHEERS.

traderhc

PS, while the management of writing and twitter becomes more time-intensive, I will begin monetizing. For now, it is free to read new articles, but you must be a paid sub to read articles after 7 days.

IF YOU BECOME A PAID SUB, YOU WILL SEE A TRADE BELOW THAT DOES NOT GET SHOWN FOR FREE ON TWITTER OR HERE.