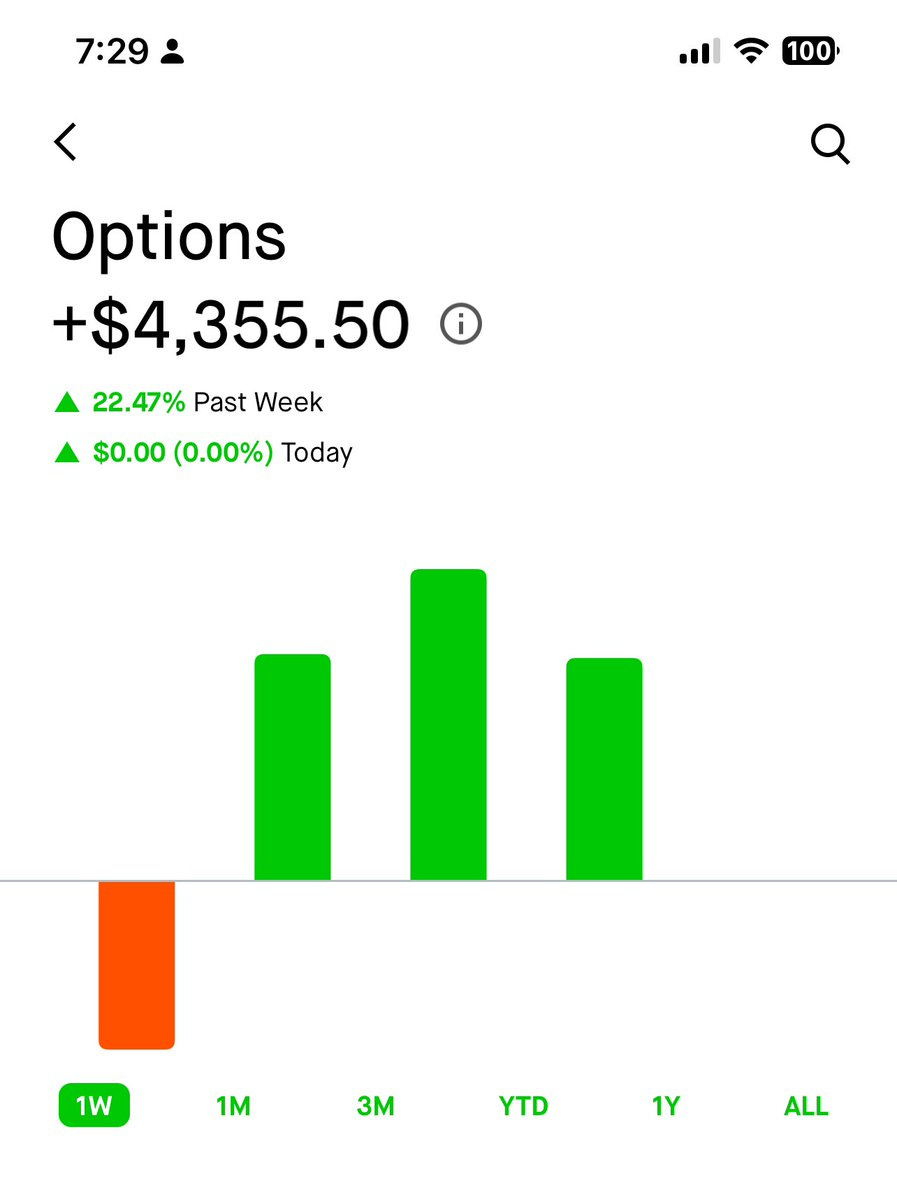

Last Week: PLTR COIN MARA big hits

Consistent alpha since I got back from Mexico Mid-January. The markets have been hot, and there have been an excess of plays to hit in this environment.

It’s very hard to know if this mania gets hotter, or sours by a volatility event. I am prepared for either outcome as a trader and multi-portfolio manager.

I enjoy to never be fully allocate unless there is retained earnings coming in soon, so we have dry powder in case of hard to predict selloffs.

This Week:

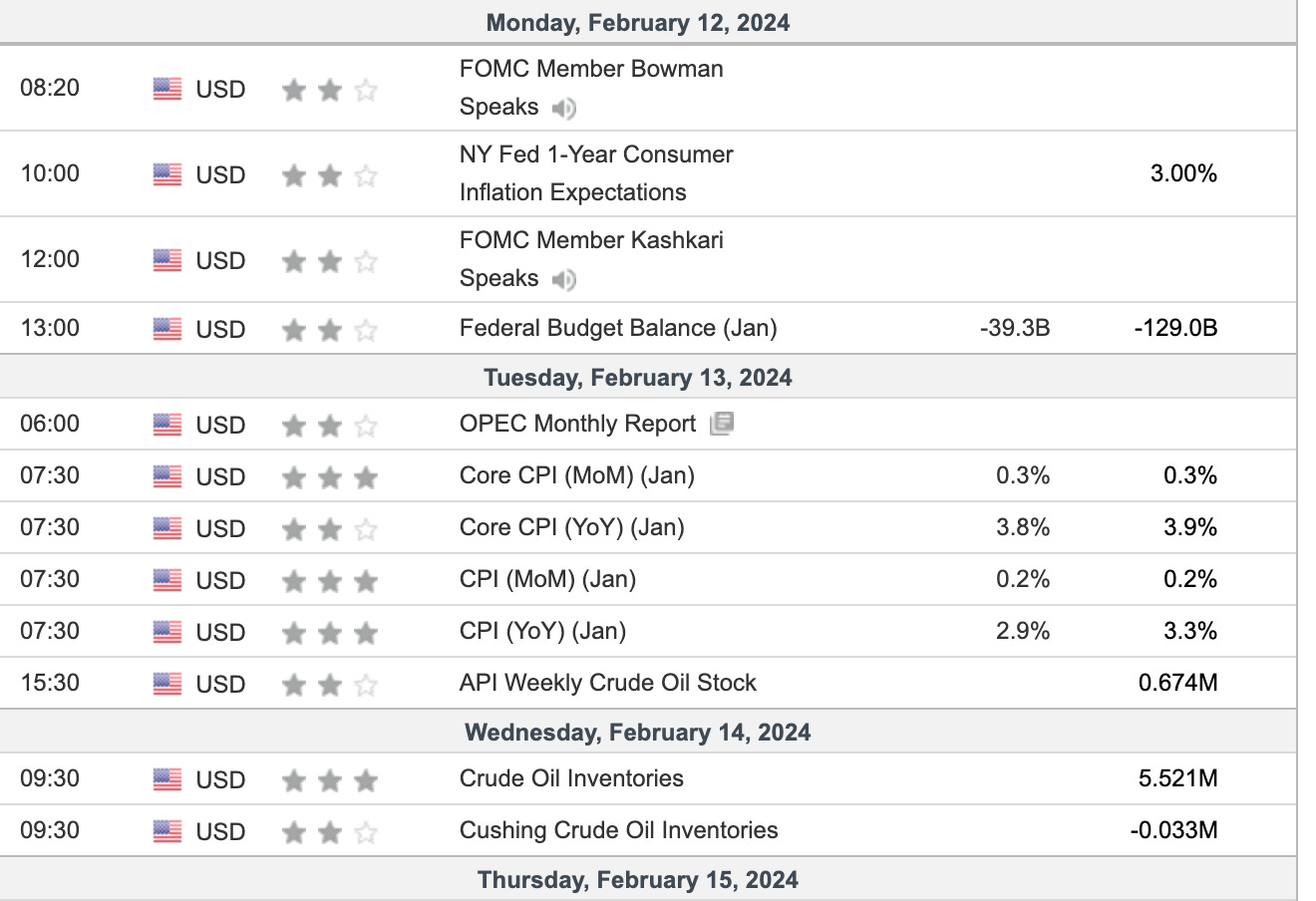

We have OPEX on Friday, Vixperation Wednesday morning, CPI Tuesday, and more earnings to be announced. This provides us with anothe exciting week for trading!!!

Data this week: Summary and Comments Below

M: Fed speakers

T: CPI

W: Oil data

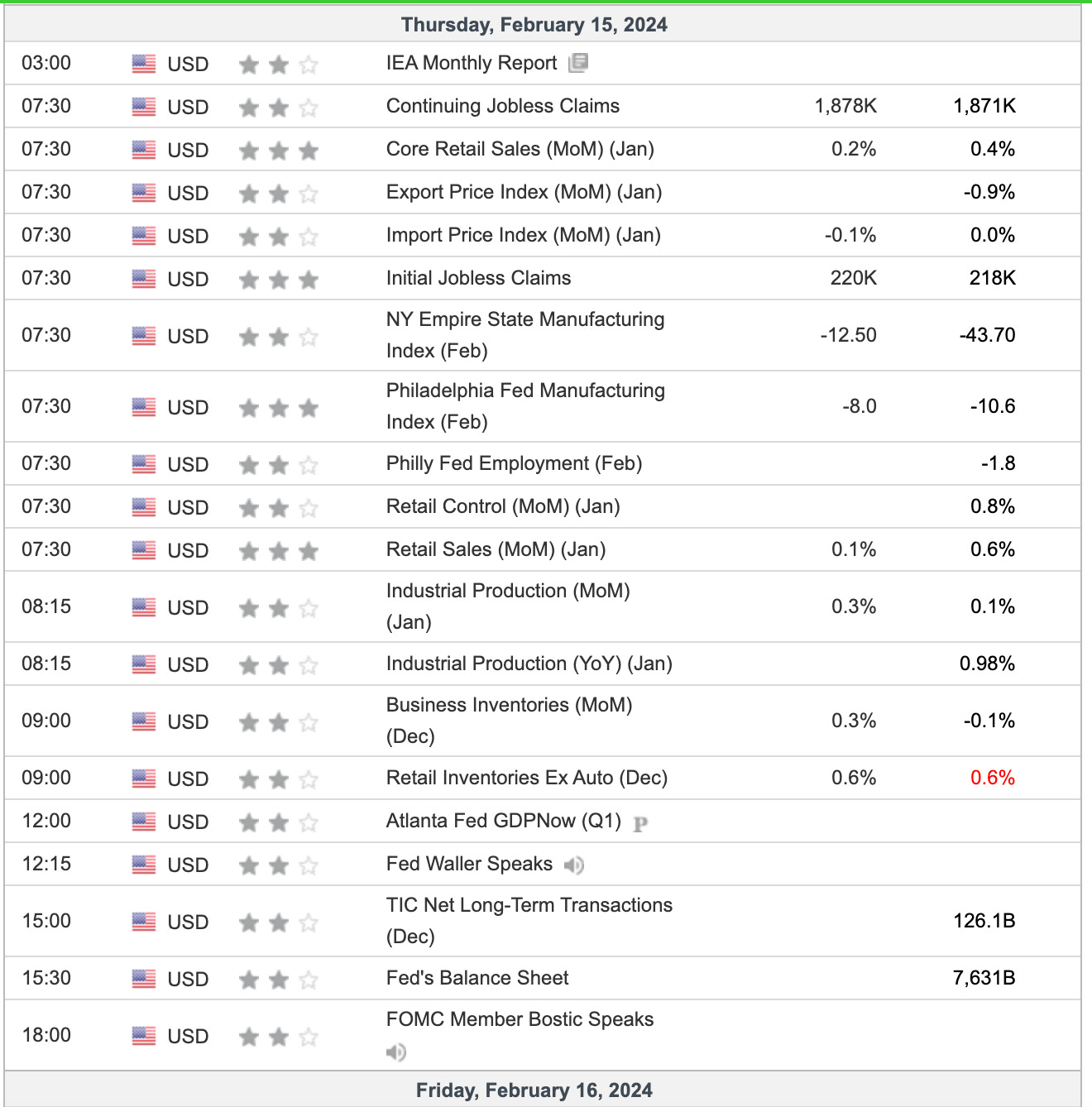

TH: Jobs data / Retail Sales / Fed speakers

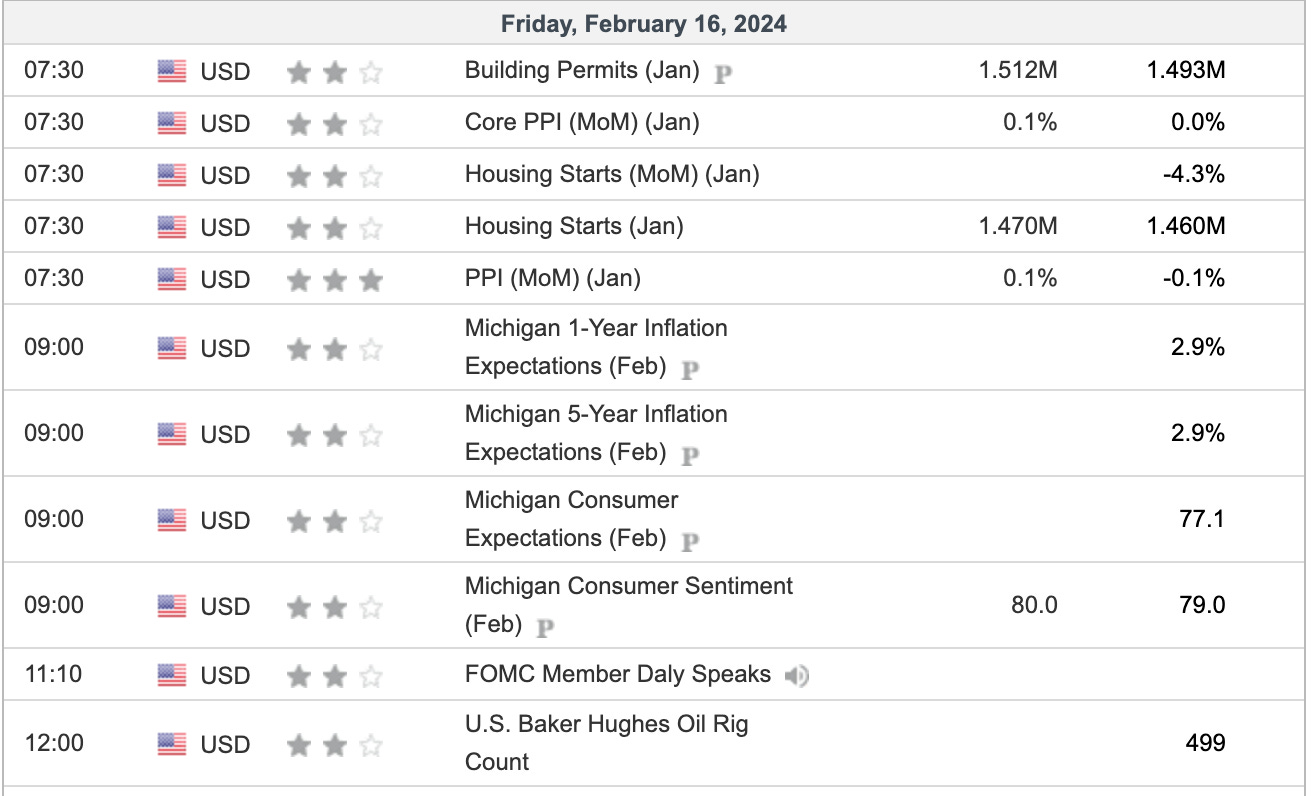

F: PPI / Building Permits / Housing Starts / Mich. data / Fed speaker

Comments:

I am assuming Fed speakers continue to talk about rate cuts and CRE as the main narratives. CPI is projected to come in lower at 2.9% (even lower than last week’s 3.0%) which I agree with even though oil has been rallying. Jobless claims can continue to grind higher while retail sales come in a little weaker as consumers may be attempting to spend less. Housing market should print some moderate data as it continues to be stable.

More below for actionable alpha with this data coming.