Last Week:

First red week in 5 weeks!! Took a loss on the TLT 2/23 95C for -12k.

Challenge Account is at 65k from 6k start.

Data this week: Summary and Comments Below

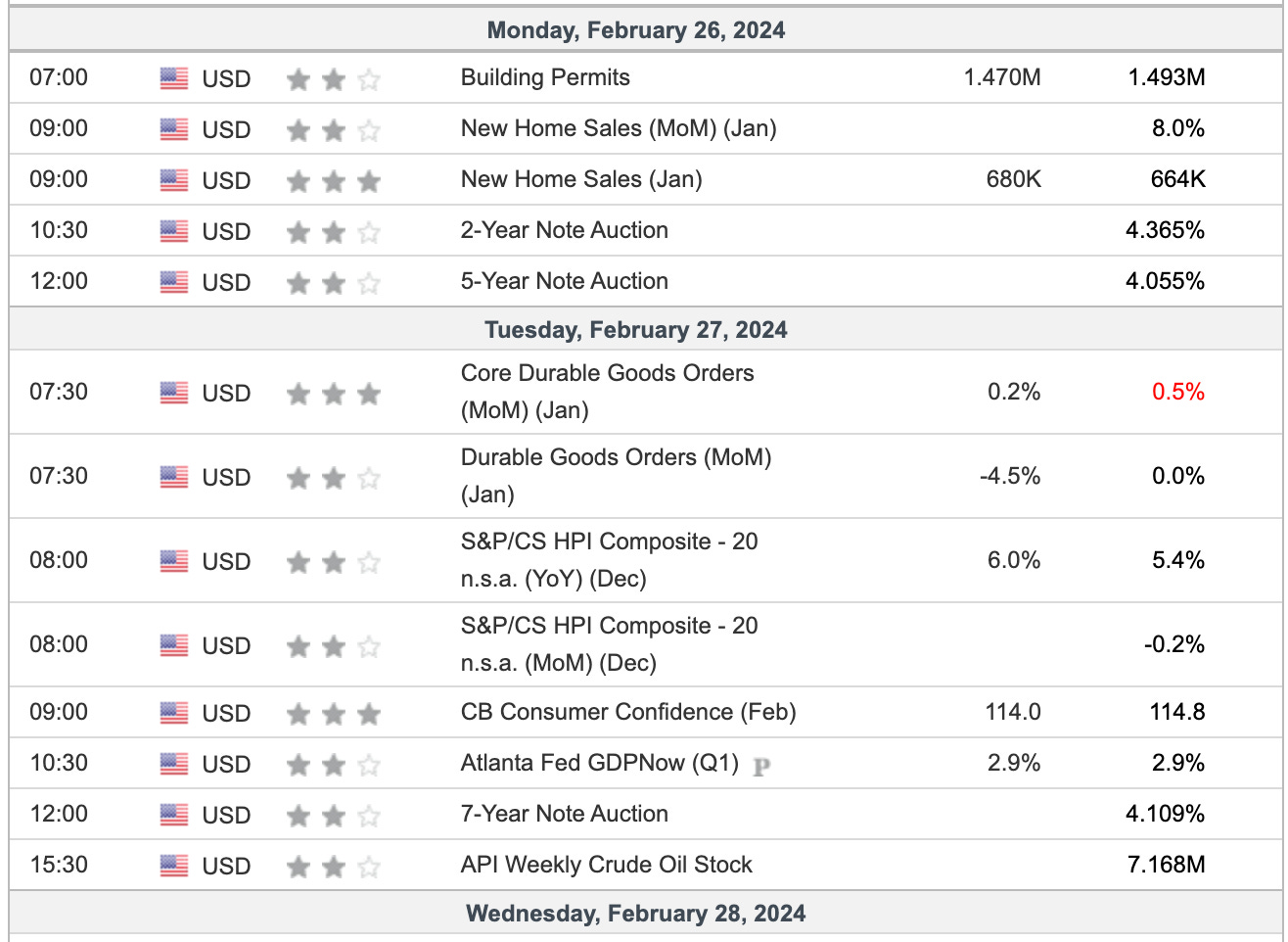

M: 2 and 5Y auction, New Home Sales, Building Permits

T: 7Y auction, Durable Goods Orders, Consumer Confidence

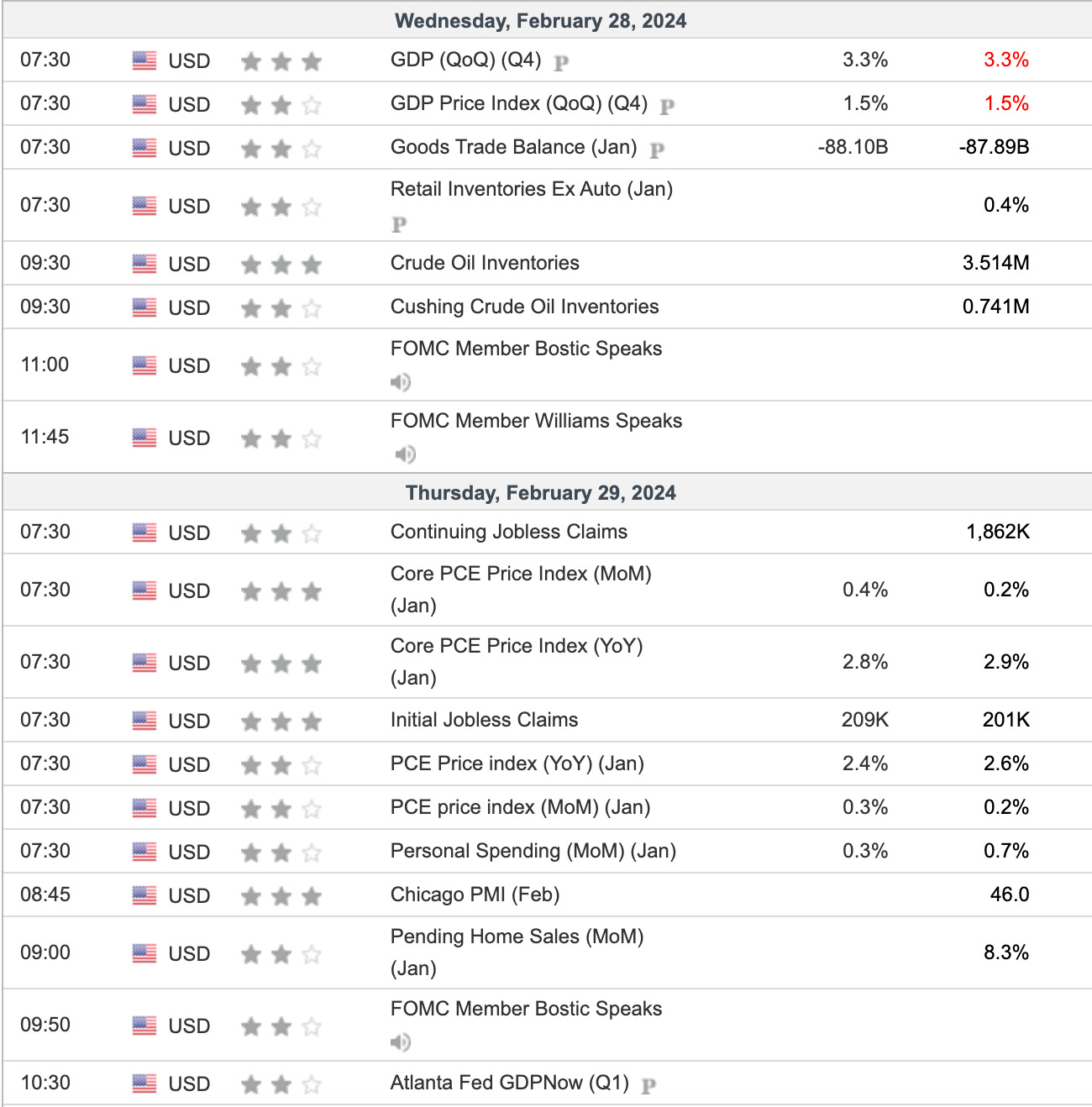

W: GDP Q4 revised, Fed Speakers

TH: PCE, Jobs Data, PMI, Fed Speakers

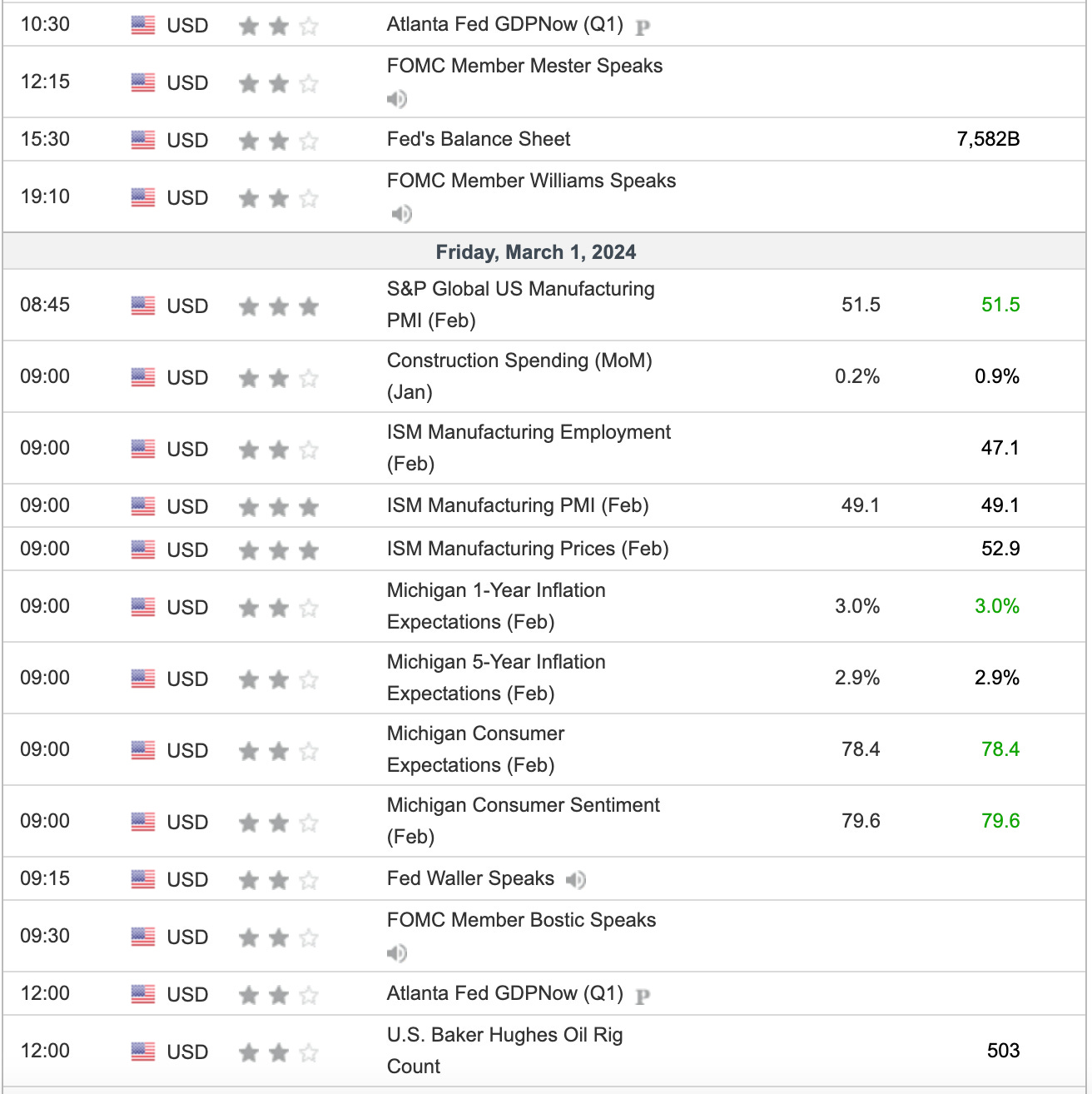

F: PMI, Prices, and Fed speakers

Comments:

Another heavy week of fed speakers while we get auctions early in the week. I continue to be bullish on Treasuries this week and think the auctions will go very well. I would like to see durable goods orders and consumer confidence come in weaker than expected.

PCE- Forecasts are showing that I am thinking….YoY will continue to trend down, but MoM is gunna come in a little hotter. That is what my consensus is…Inflation is trending down, but we had a retrace the last sets of data ie last CPI. I do believe this is caused by the lag in data.