Loaded week of events, so I will refocus to mainly TradFi for option trading.

Last Week:

Good week as I build the small account with options as the big account sits in it’s positions and awaits next tranche of allocation.

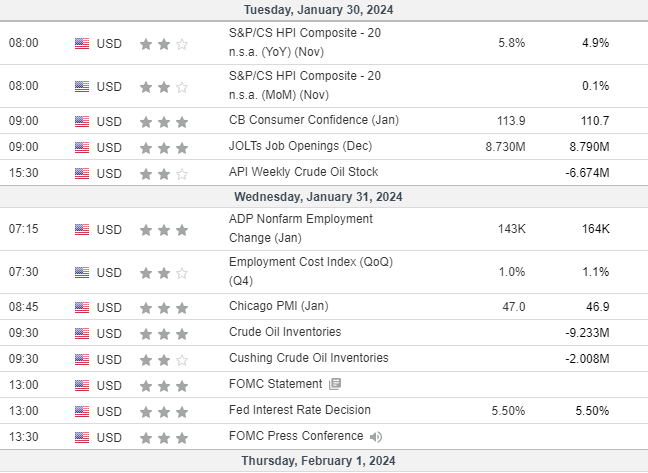

Data this week: Summary and Comments Below

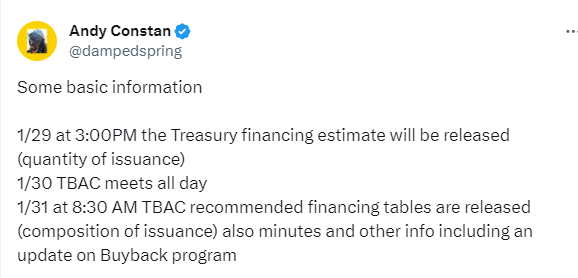

T: Consumer Confidence / JOLTS / QRA 1h before closing bell

W: ADP Nonfarm / Chicago PMI / FOMC rate decision

TH: OPEC meeting / Jobless Claims / Manufacturing Data

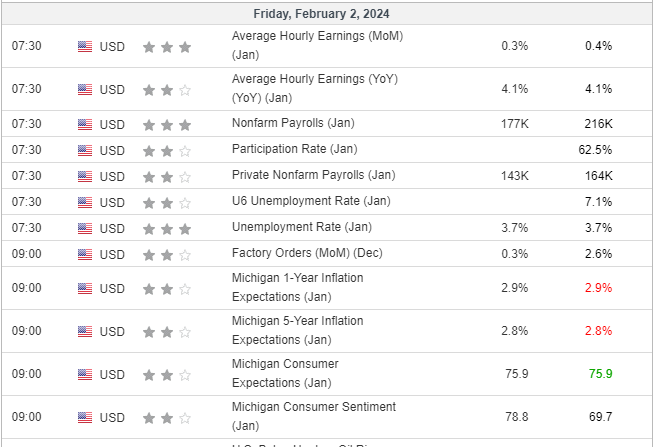

F: NFP / Unemployment Rate

Huge week with QRA, job market data, and FOMC. I want to point out that the jobs data is looking to come in hot(stronger jobs market data) based on forecasting, but JOLTS can continue to fall. This is bull/goldilocks continuing. More details below since this is just a few variables to analyze before making a conclusion.

HUGE WEEK FOR YIELDS / TREASURIES